IDTechEx Summarizes DMS+OMS Integrated Technology and the Driver Behind a US$17 Million Deal

|

Author: Yulin Wang, Senior Technology Analyst at IDTechEx

In-cabin monitoring, comprising both Driver Monitoring System (DMS) and Occupancy Monitoring System (OMS), has experienced significant growth since the start of 2024. Traditionally, DMS relies on 2D infrared cameras, while OMS utilizes 3D sensing modules like 3D time-of-flight (ToF) cameras or radar modules. At CES 2024, Melexis and emotional3D unveiled a 3D ToF-based solution that integrates both DMS and OMS into a single camera. This solution employs Melexis’ automotive-qualified MLX75027, a true VGA ToF imager, along with emotion3D’s CABIN EYE software to simultaneously generate IR and distance images. The MLX75027 imager boasts a maximum FPS (frames per second) of 120 and a 110° field of view, simplifying the traditional setup requiring two cameras. However, IDTechEx observed that it offers lower resolution compared to traditional 2D IR cameras.

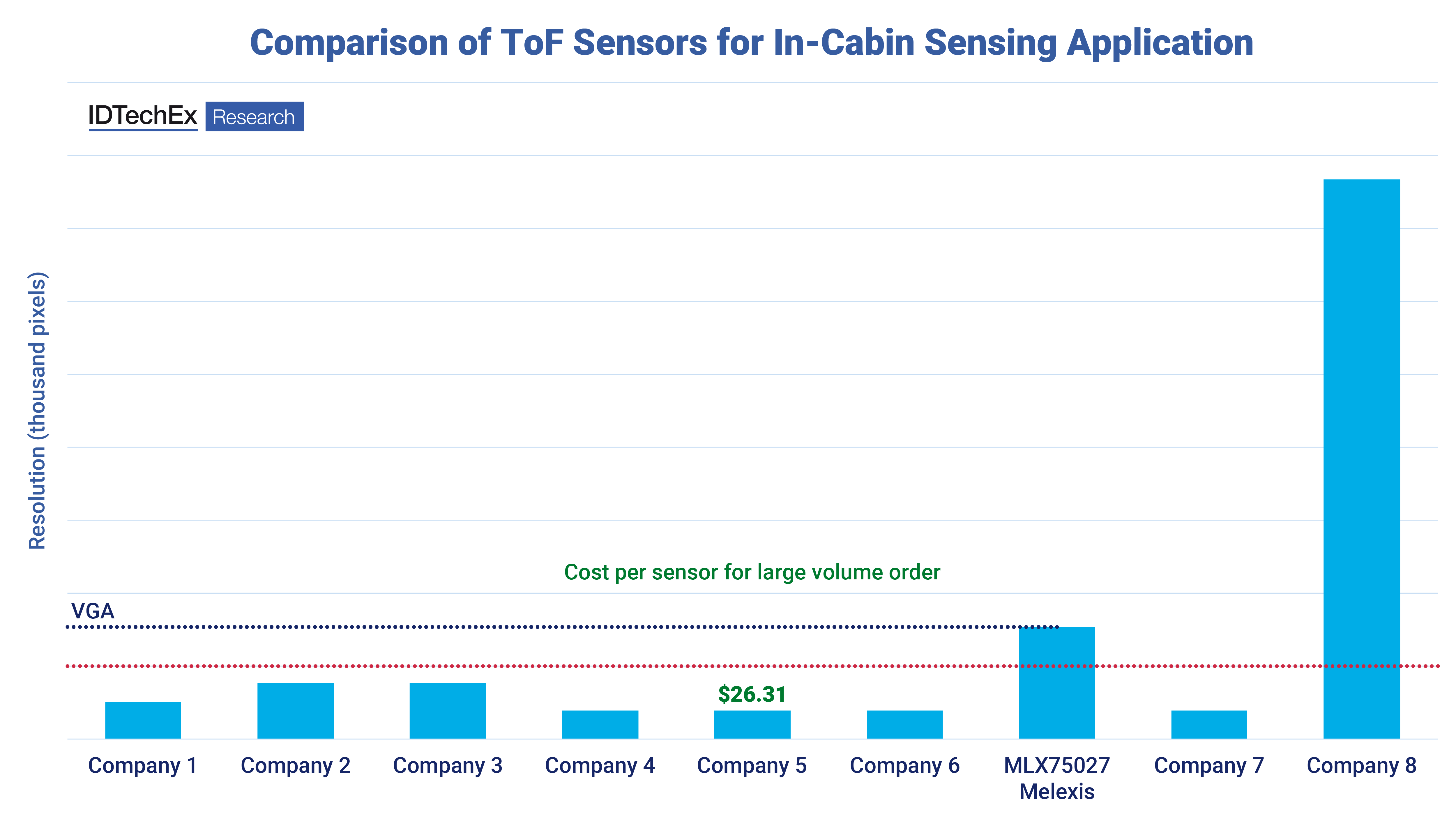

IDTechEx summarizes the resolutions of different ToF sensors for in-cabin sensing. Melexis MLX75027 stands out with slightly higher resolution, making it suitable for both DMS and OMS. The cost per ToF sensor varies significantly based on factors such as resolution, order volume, and others. For large-volume orders (1000 units), the cost per ToF sensor typically ranges between US$20 and US$40, with the potential for even lower costs at higher volumes. Cost remains a key consideration for the automotive industry, and IDTechEx’s market report on the topic, “In-Cabin Sensing 2024-2034: Technologies, Opportunities and Markets“, provides insights into the cost per unit of ToF imagers, ToF camera units, and other commonly used DMS/OMS sensors. |

|

|

|

Comparison of Time-of-Flight (ToF) imagers for in-cabin sensing reveals a cost of approximately US$30±10 per unit for large volumes (1000 units). Source: IDTechEx |

||

|

Another recent development accelerating the adoption of combined Driver Monitoring System (DMS) and Occupancy Monitoring System (OMS) for the in-cabin sensing market is the projected US$17 million revenue agreement between Smart Eye, a prominent software player in the cabin-sensing sector, and a leading Korean vehicle manufacturer. While the Korean OEM has previously tested Smart Eye’s software on various car models, this deal marks the first instance of Smart Eye delivering its combined DMS and cabin monitoring system (CMS) technology to four new car modules, slated for production between late 2025 and the first half of 2026. IDTechEx suggests that this reinforces the trend of integrating DMS and OMS solutions, particularly at the software level, presenting significant opportunities for hardware manufacturers like image sensor suppliers and camera suppliers. IDTechEx’s research, “In-Cabin Sensing 2024-2034: Technologies, Opportunities and Markets”, analyzes numerous leading hardware and software players, offering insights into their technologies and recent market developments.

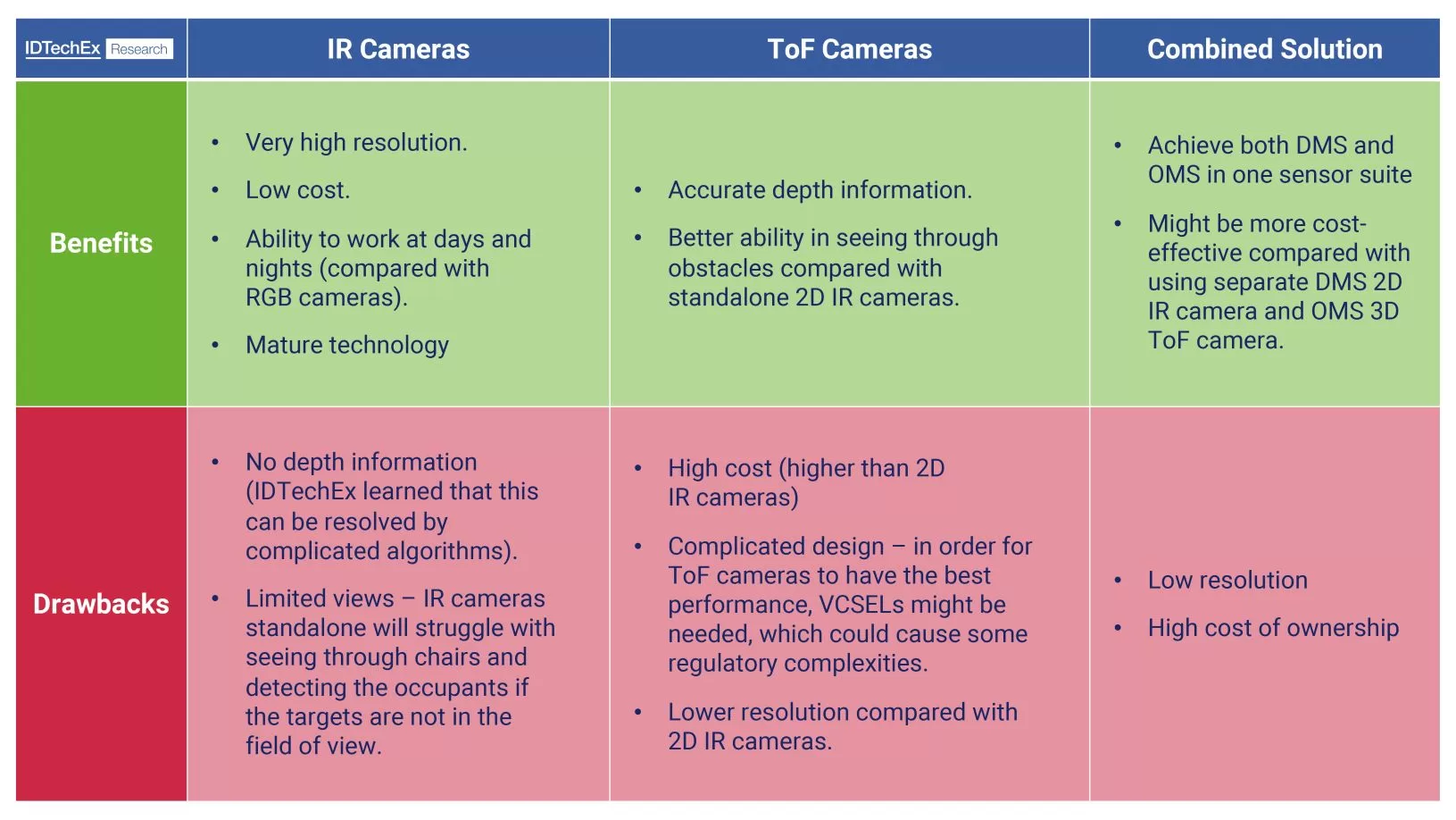

The year 2024 emerges as pivotal for the commercial adoption of DMS, as the European Commission mandates specifications for driver and vehicle monitoring in the type approval requirements of General Safety Regulation (GSR) systems for new vehicle registrations. These specifications include the ability to detect driver fatigue or inattention. Traditionally, this is achieved through high-resolution infrared (IR) cameras using wavelengths of 940nm or 850nm to minimize emitted light distraction. While effective in features such as gaze tracking, eyelid closure, and head motion, this technology lacks 3D depth information. With the shift towards electric vehicles, interior features become a distinguishing factor, compelling automotive OEMs, especially mid- to high-end OEMs, to integrate both DMS and OMS technologies into their vehicles. However, employing separate IR cameras and 3D sensors (e.g., radar modules and 3D ToF cameras) can incur high costs and complicate design. Therefore, combining 3D ToF cameras with 2D IR cameras to achieve both DMS and OMS represents a cost-effective solution for vehicle manufacturers, striking a balance between the capabilities of 2D IR cameras and 3D ToF cameras. |

||

|

Benefits and drawbacks of 2D IR cameras and 3D ToF Cameras. Source: IDTechEx |

||

|

IDTechEx also compares the benefits and drawbacks of 2D IR cameras, 3D ToF cameras and their combined solution. More in-depth analysis of the pros and cons of more sensors is included in the “In-Cabin Sensing 2024-2034: Technologies, Opportunities and Markets” report.

In-Cabin Sensing 2024-2034: Technologies, Opportunities and Markets The Global In-Cabin Sensing Market Will Exceed US$8.5 Billion by 2034

This IDTechEx report provides a comprehensive technical analysis of in-cabin sensors, covering NIR/IR cameras, ToF cameras, radar, capacitive steering sensors, and torque steering sensors designed for in-cabin monitoring (DMS and OMS). It includes 10-year forecasts for volume sales (in millions), revenue (in US$ millions/billions), and sensor unit prices (in US$) across various regions, including China, Europe, the USA, Japan, and the Rest of the World. The document explores recent advancements in high-performance technologies, successful commercial applications, and notable acquisitions and partnerships involving Tier One and Tier Two players. Additionally, the report outlines emerging trends in the future of in-cabin sensors.

To find out more about this market report, including downloadable sample pages, please visit www.IDTechEx.com/InCabinSensing. |