Key Second Life BESS Market Developments

Author: Conrad Nichols, Senior Technology Analyst at IDTechEx

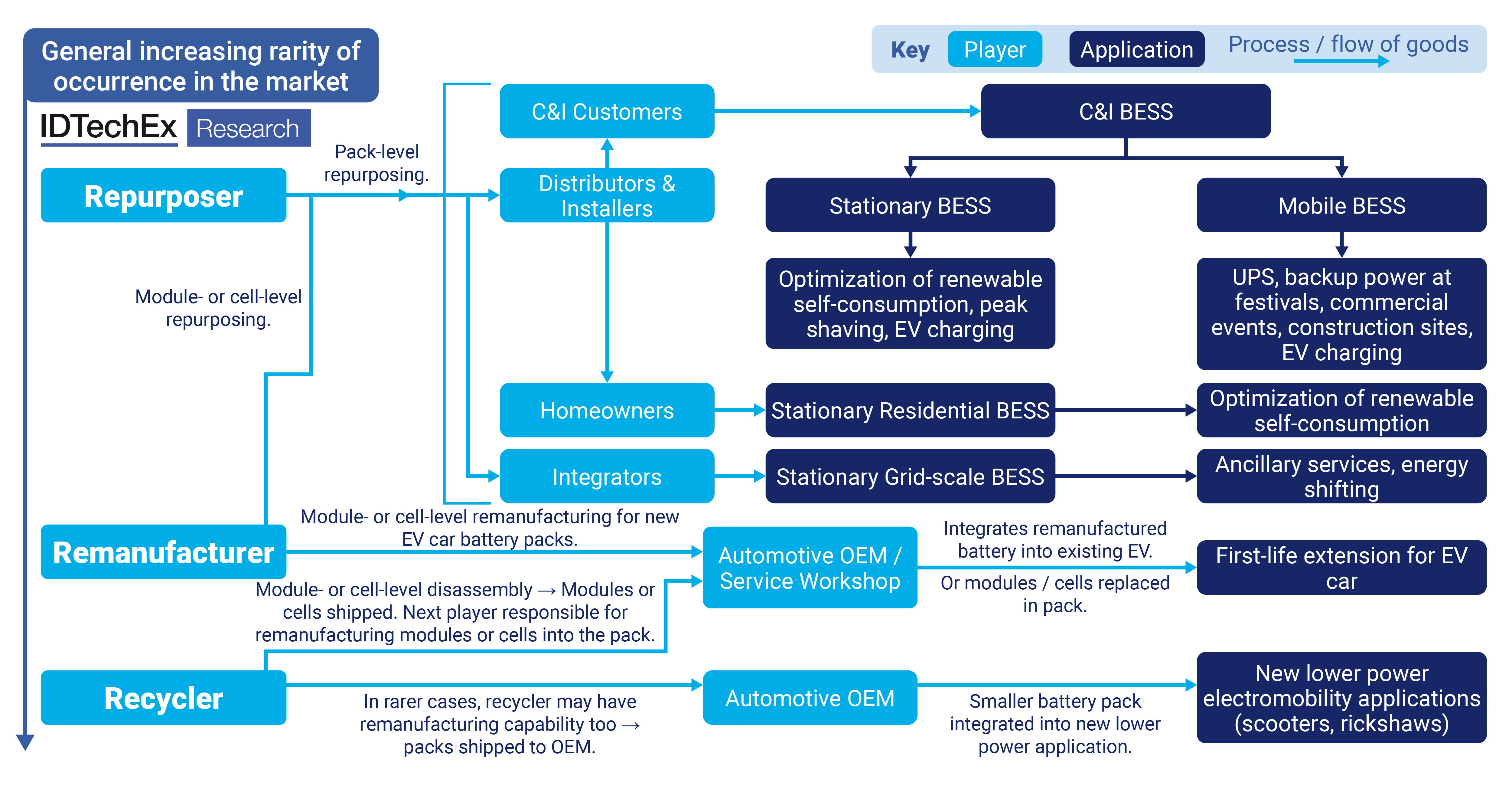

Retired electric vehicle (EV) batteries can be repurposed for second-life applications such as stationary energy storage and lower power electromobility applications. In some cases, cells or modules can be replaced with new counterparts, which would see EV batteries remanufactured and have their first life extended for use in an EV. These cases all extend the lifetime of the EV battery, maximize its value, and can reduce the CO2 associated with the battery (e.g., production, transportation, recycling) per kWh discharged over the entire lifetime of the battery. Of these applications, second-life battery energy storage systems (BESS) dominate, and several key repurposers and automotive OEMs across Europe and the US have continued to steadily deploy these systems, mostly in their respective regions. Key trends are emerging that suggest where the second-life battery market will develop and what applications these technologies will be used for. As written in their recently updated market report, “Second-life Electric Vehicle Batteries 2025-2035: Markets, Forecasts, Players, and Technologies“, IDTechEx predicts that by 2035, the global second-life EV battery market will be valued at US$4.2 billion.

Key second-life BESS applications

The majority of second-life battery repurposers are creating containerized second-life BESS for C&I applications. C&I battery storage customers may look to use technologies to optimize renewable energy for self-consumption, for peak shaving, or for EV charging applications. Some repurposers have also developed second-life residential battery storage systems. Revenues generated by repurposers would mainly be through sales of their second-life technologies to customers, which are shipped and installed via their partners, i.e., distributors and installers. Revenues for C&I battery storage could also stem from operating the battery and/or performing maintenance over the battery's second lifetime.

Some repurposers are developing second-life mobile BESS technologies, which could be used for EV charging applications, or temporary C&I applications to provide uninterruptible power supply (UPS) at festivals, commercial events, construction sites, and disaster relief scenarios. These repurposers will likely generate revenues from renting out their systems and will collect these batteries at the end of a project back from the customer and repeat the process; this requires in-house infrastructure to store these batteries. Zenobē is a key company that rents its second-life batteries out to customers. The market report from IDTechEx discusses key second-life battery business models and why these may be needed such that repurposers can offer systems competitively against first-life Li-ion BESS technologies, which continue to decline in price.

Second-life EV battery applications and supply chain overview. Source: IDTechEx

Key second-life battery player activity

IDTechEx has identified over 20 players repurposing retired EV batteries for second-life applications globally (excluding China). In some cases, automotive OEMs have also been directly responsible for developing their own second-life battery projects. The majority of repurposers are concentrated in Europe, with key players including BeePlanet Factory, Connected Energy, Allye Energy, and Zenobē. Given the early stages of repurposer business development, the majority of second-life battery storage deployments have, therefore, also mostly been found in Europe, or in the countries of a repurposer's headquarters. IDTechEx would expect this trend to continue in the medium term, given the greater number of European repurposers active in the second-life EV battery market and the limited cases of overseas second-life battery storage deployments.

However, in the US, key player B2U Storage Solutions has several utility-scale second-life BESS projects, amounting to over 50 MWh. Also, in November 2024, it was reported that Element Energy, a second-life energy storage and battery management system (BMS) company, commissioned a 53 MWh second-life BESS. The system, which uses 900 EV batteries and was integrated by LG ES Vertech, marked the largest second-life BESS globally at the time. The BESS has been providing services to the ERCOT's electricity grid in Texas.

Second-life BESS market activity outlook

IDTechEx would expect the majority of second-life BESS projects in Europe and the US to be developed for C&I customers. However, infrequent utility-scale projects, reaching dozens of MWh could start to dwarf C&I projects. However, this relies on repurposers possessing in-house knowledge or relying on partners to integrate utility-scale BESS technologies and operate them in electricity markets. In China, IDTechEx expects second-life EV battery market demand to be dominated by backup power or UPS for telecom towers. This is due to the ban on large-scale second-life BESS in the country, which seemingly is yet to be lifted. Ultimately, the second-life EV battery market continues to grow, albeit at a relatively slow pace, especially compared to the volume of first-life Li-ion BESS technologies being deployed.

See IDTechEx's “Second-life Electric Vehicle Batteries 2025-2035: Markets, Forecasts, Players, and Technologies” report for more detailed information on second-life batteries, including:

- Key players

- Technologies

- Markets

- Applications

- Business models

- Revenue streams

- Repurposing processes

- Techno-economic analyses against first-life Li-ion BESS

- Regulations

- EV battery and second-life battery trends

- EOL battery testing and grading technologies and players

- Access to 30+ company profiles

- 10-year market forecasts for second-life batteries

- 10-year market forecasts for retired EV battery availability

To find out more, including downloadable sample pages, please visit www.IDTechEx.com/SecondLife.

For the full portfolio of related market research available from IDTechEx, please see: